30 Oct Why Don’t More California Homeowners Have Earthquake Insurance Coverage?

855-368-5502

Why Don't More California Homeowners Have Earthquake Insurance Coverage?

By: Adam Matheny

On October 17, 1989, the California Bay Area suffered a major earthquake that caused many freeways to collapse, resulted in 63 deaths, and racked up billions in damage costs. What might surprise you, is that 25 years later only 10 percent of the over 7 million homeowners in the state are protected by earthquake insurance. Experts all agree that pressure is building along the Bay Area fault lines and that another major quake could occur within the next few decades. Should such a quake occur with this level of protection, it could cost homeowners and the U.S. economy billions.

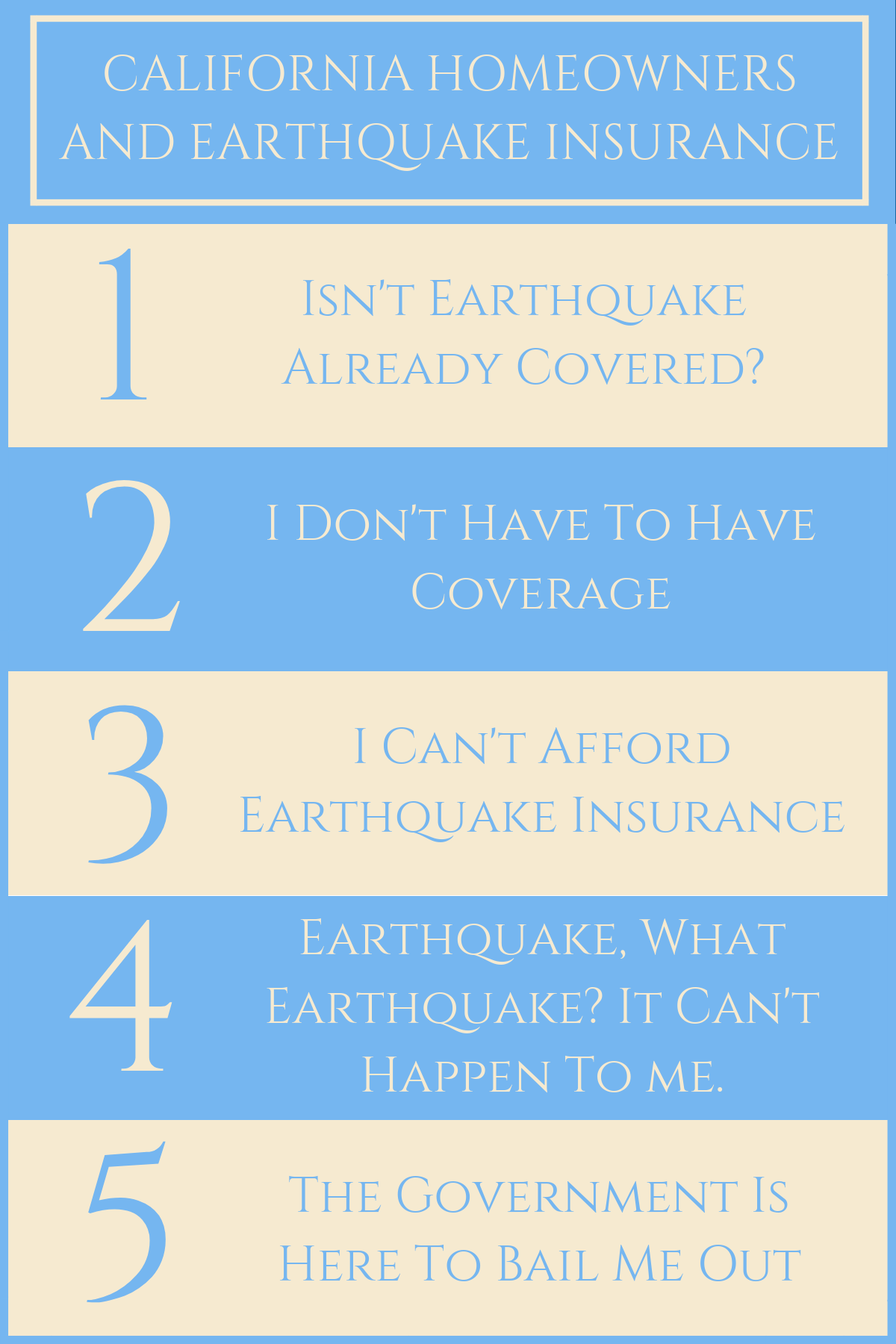

So why do so many California homeowners go without earthquake insurance? There’s several reason, here are the most common ones according to insurance and real estate experts.

Isn't Earthquake Already Covered?

Far too many people do not bother to read their insurance policies and have no idea they are not covered. They go along in blissful ignorance until a quake occurs only to find out they are not covered.

I Don’t Have to Have Coverage

Back in 1985, a law was passed in the state of California that required insurers to include earthquake coverage in homeowner’s insurance policies. The hope was that this would make coverage affordable, but as you can see this did not work. In the beginning, this new law raised the percentage of those covered up to 20 percent.

However, following the 1994 quake in the San Fernando Valley that cost homeowner’s insurers $12 billion, many companies stopped offering earthquake insurance, while others significantly raised the cost of premiums. This led to the creation of the CEA that guarantees everyone has access to earthquake insurance but does not require homeowner’s to actually purchase it.

I Can't Afford Earthquake Insurance

The average premium for earthquake insurance in California ranges from a low of $800 to as much as $5,000 per year. More importantly, the average deductible is around 15 percent. With the high cost of homes in California, insurance is expensive. Consider the average price of a home in the state is approximately $400,000, in which case the deductible would be $60,000. When you live on a modest income, this type of deductible can easily be out of reach.

Surprisingly, those who can afford earthquake insurance tend to be the ones who go without this type of coverage the most. There have even been instances in which professionals such as insurance agents, estate planners, even financial advisors have advised their clients not to buy this type of insurance.

Earthquake, What Earthquake? It Can't Happen To Me.

Far too many people now living in California have never experienced the destructive power of an earthquake and see no reason to invest in this type of coverage. “It can’t happen to me” may be one of the most common excuses people give for just about anything. It is human nature to firmly believe that things like this happen to other people, not to themselves. It can be very hard to convince the average person to prepare for something with such a low probability of occurring.

The Federal Government Is Here to Bail Me Out?

Unfortunately, a number of people are under the mistaken impression that should their home and property be destroyed by an earthquake; the federal government will be there to bail them out. Although the government will declare an emergency and FEMA will arrive to assist, their role is only to help people get back into their homes. They are not there to replace your home. In fact, the level of aid is limited to $32,000 for homeowners with the bulk of the money coming in the form of a loan offered by the Small Business Administration once the personal property losses top $40,000 and real estate losses top $200,000.

However, homeowners will still have to pay their mortgage payments and the loans do have to be paid back. Yet even with all of this, there won’t be enough money to cover the full cost of replacing the home and everything in it. Don’t count on the feds to rescue you, make sure you have earthquake insurance to cover all potential losses.