18 Sep Procuring Unoccupied Insurance

855-368-5502

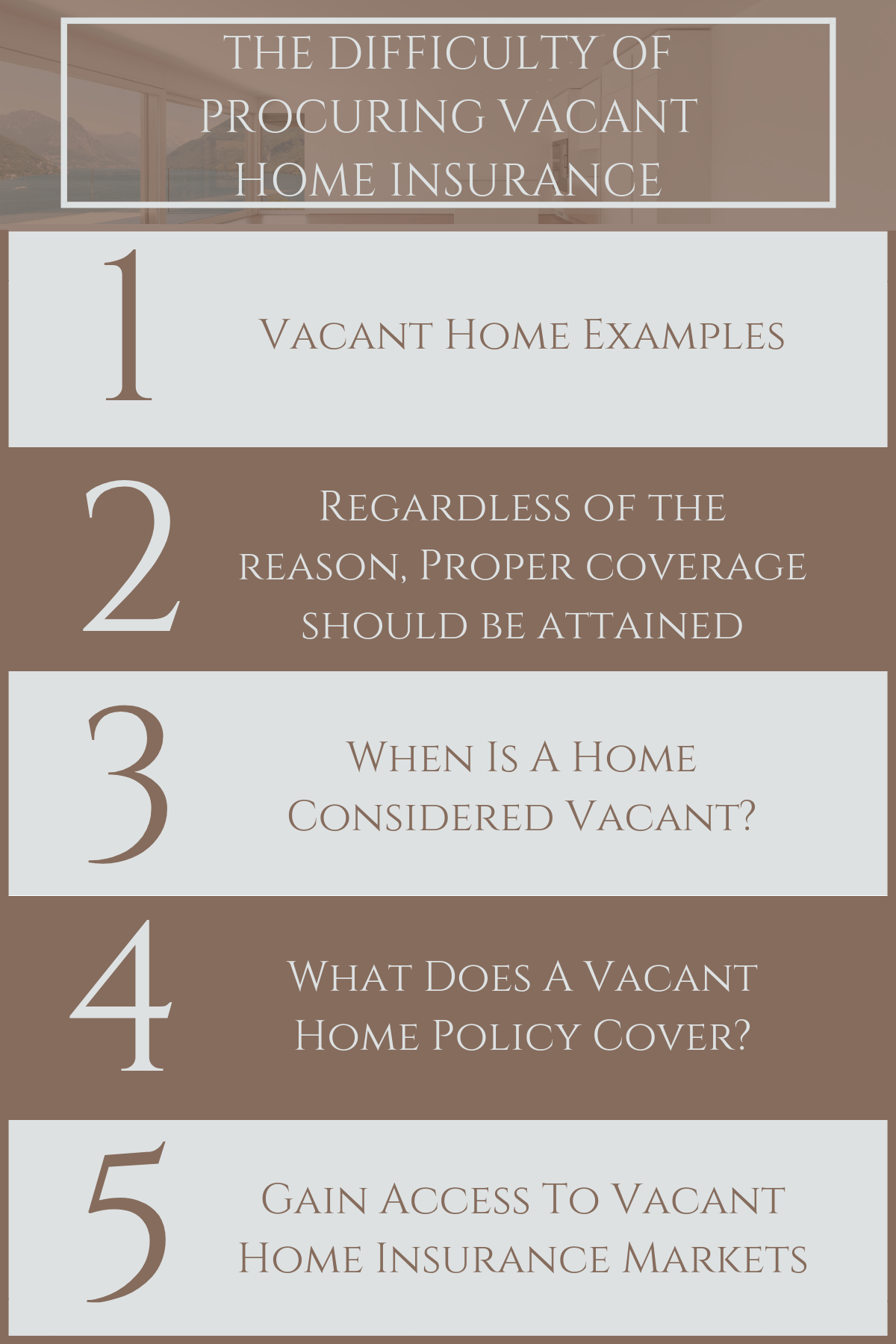

The Difficulty Of Procuring Vacant Home Insurance

By: Adam Matheny

There are numerous reasons why a home could be left unoccupied for an extended period. Among the most common reasons for leaving a dwelling to go vacant for long periods of time are renovation and new construction. If the property is up for sale in a slow market, this could also cause it to be left unoccupied for months. Then there are those properties that are primary and secondary homes, each of which might be left empty for months at a time A perfect example of this would be the “Snowbirds” or people who live up north for the summer, but have a second home in states like Florida, California, and Arizona.

No Matter The Reason

Whatever the reason a property might be left vacant for a long time, there is no reason why it should be left without the proper insurance coverage. The reality is that a home that is left unoccupied is vulnerable and susceptible to more forms of risk than a house that is occupied. No matter why your property must remain vacant for long periods of time, it faces not only the same risks of damage as an occupied dwelling but many others, which is where having the property covered by an unoccupied property insurance policy steps in.

When Is A Home Considered “Vacant”?

Depending on where you live, your property may become “legally vacant” after 30 consecutive days. When this happens, you could be required to purchase additional insurance coverages on top of the standard homeowner’s coverage. Both occupied and vacant property policies are very similar to each other in that they can be customized to the person’s exposures and needs more accurately.

What Does It Cover?

The average unoccupied property insurance policy covers damage caused by fire, wind, explosion, hail, vandalism, and theft. Depending on the policy, this coverage may extend beyond the physical structure and cover the owner’s personal property such as tools used for maintenance, furniture, appliances, and so forth. The coverage is designed to help protect the property owner from financial costs resulting from damage to the home caused by things like Mother Nature, theft, or third-party individuals. Of the most common reasons given for not having this type of coverage, affordability and availability are at the top of the list.

Partner With The Best

Flow Insurance Services knows vacant home, and we know it well. Place your trust in us and let us help you to write more business. When it comes to growing your business, things can be challenging. Embrace the opportunity of vacant home insurance!