855-368-5502

Washington has More Earthquake Insurance Than Expected, But Is It Enough?

By: Adam Matheny

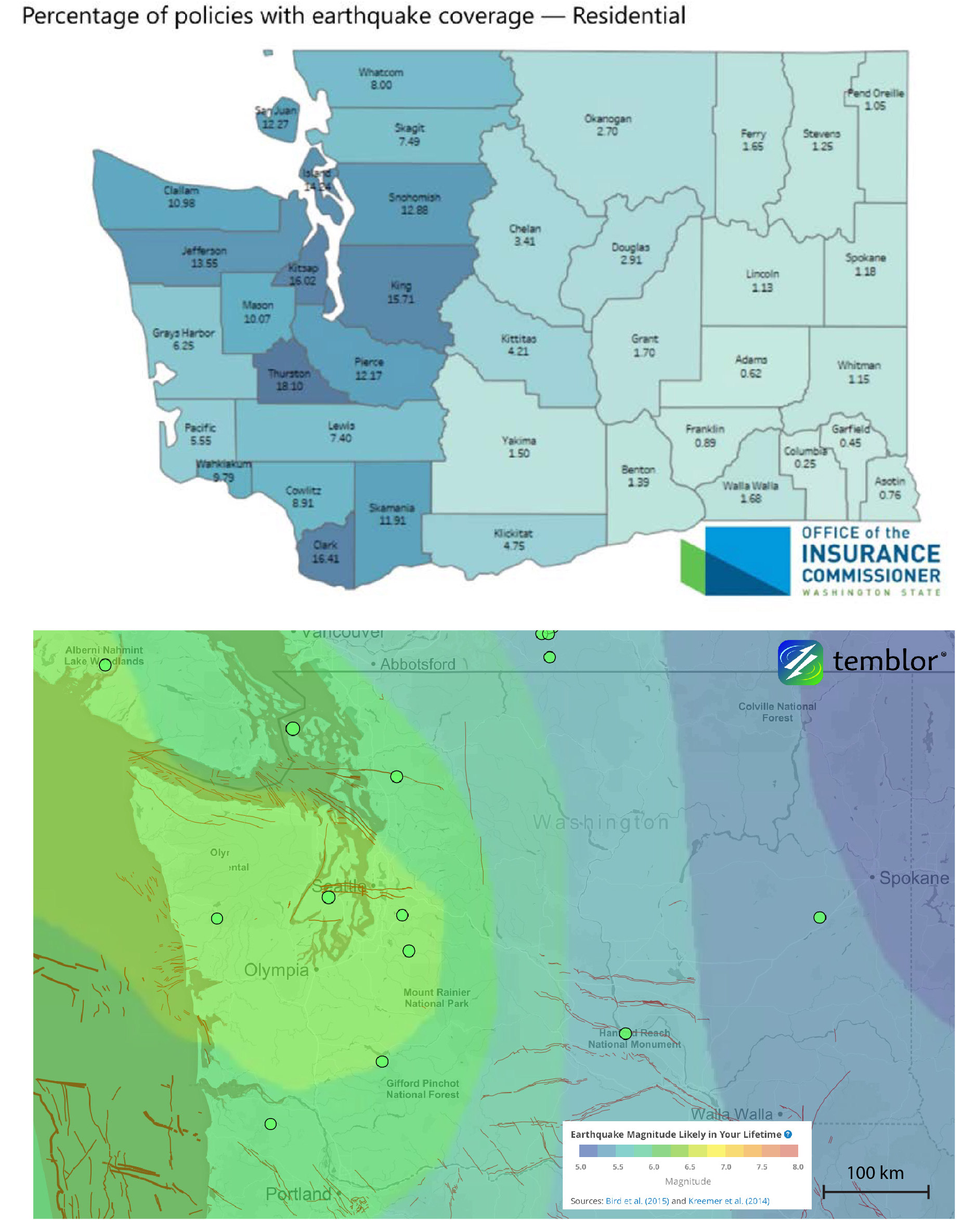

Living in the Pacific Northwest has a lot going for it – there is large job growth, there’s a large range of outdoor activities from lakes to mountains, and the fertile soil grows some of the world’s best hops and grapes for beer and wine. At the same time, the Cascadian Subduction Zone that runs from Cape Mendocino to Vancouver Island and the Seattle Fault Zone running under the City of Seattle and the Puget sound puts millions at risk. One of the best ways people can protect themselves is by purchasing earthquake insurance. Recently, the Washington Insurance Commission revealed for the first time the percentage of residential earthquake insurance policies in the state.

The Last Big Quake

The last time this area experienced a major quake was in 20001, which was the Nisqually Quake that registered M=6.8. This quake caused more than $2 billion in damage of which only $350 million was covered by insurance. If the area experienced a M=9.0 quake, the damage would likely be catastrophic. Many scientists believe the amount of damage that could be caused by the Seattle Fault would be very similar to that of the M=6.3 quake in Christchurch, New Zealand where damages were more than $33 billion.

Bill Steele, Director of Outreach & Information Services at the Pacific Northwest Seismic Network, believes that these localized hazards deserve far more attention than they are currently getting. Things like the “Cascadia Rising” national exercise and “The Really Big One” by Kathryn Schultz and published in the New Yorker, have brought Cascadia to the forefront. Steele said, “especially in the Puget Sound area a Seattle Fault earthquake is the worst-case scenario. It is vital for those living in the Evergreen State to understand the risks and how best to ease losses.

Not Enough Coverage

While earthquake insurance in the entire state runs 11.3%, the rate of coverage west of the Cascades sits at 1.38%, which is only slightly lower than the rated in California, where there is a significantly higher level of earthquake activity. The big question is this enough coverage; the answer is an emphatic no!

Currently across the state, $181 million worth of residential insurance coverage exists, which might seem like a lot, but in fact, this number represents only 18% of all general insurance coverage for the state. Thus, if the state is hit by the “Big One,” the vast majority of those affected would have to pay all costs out of pocket. Oddly, commercial coverage stands at 85%. But, even with these numbers, far too many people are not covered in the event of a significant earthquake.

Why the Lack of Coverage?

With everyone living west of the Cascades at significant risk of being hit by an M=6.25+ quake, why is there such a lack of earthquake insurance coverage? This is especially true when you consider the results of such a quake would be disastrous for millions of homeowners. The answer may simply be, cost.

One of the biggest issues affecting cost, according to the Seattle Times, is the insurance companies within the state themselves. What this says, is that if an insurance company doesn’t like the terms established by the state insurance regulator, they simply stop offering earthquake insurance. Keep in mind homes covered by earthquake insurance tend to be more than 60% higher in value than similar homes in the rest of the country.

With this in mind, it is easy to see why most insurance companies simply get their way. A perfect example of this would be State Farm, the nation’s largest insurance provider. Recently, this company significantly increased the cost of insurance by as much as 117% in coastal counties like Grays Harbor and Pacific. This is a classic example of why so many homeowners who would love to have earthquake insurance have to go without.

Do You Need More Markets? Partner With The Best.

Flow Insurance Services knows earthquake, and we know it well. Place your trust in us and let us help you to write more business. When it comes to growing your business, things can be challenging. Embrace the opportunity of earthquake insurance!