09 Aug How Auto Insurers Are Adapting To Driverless Vehicles

855-368-5502

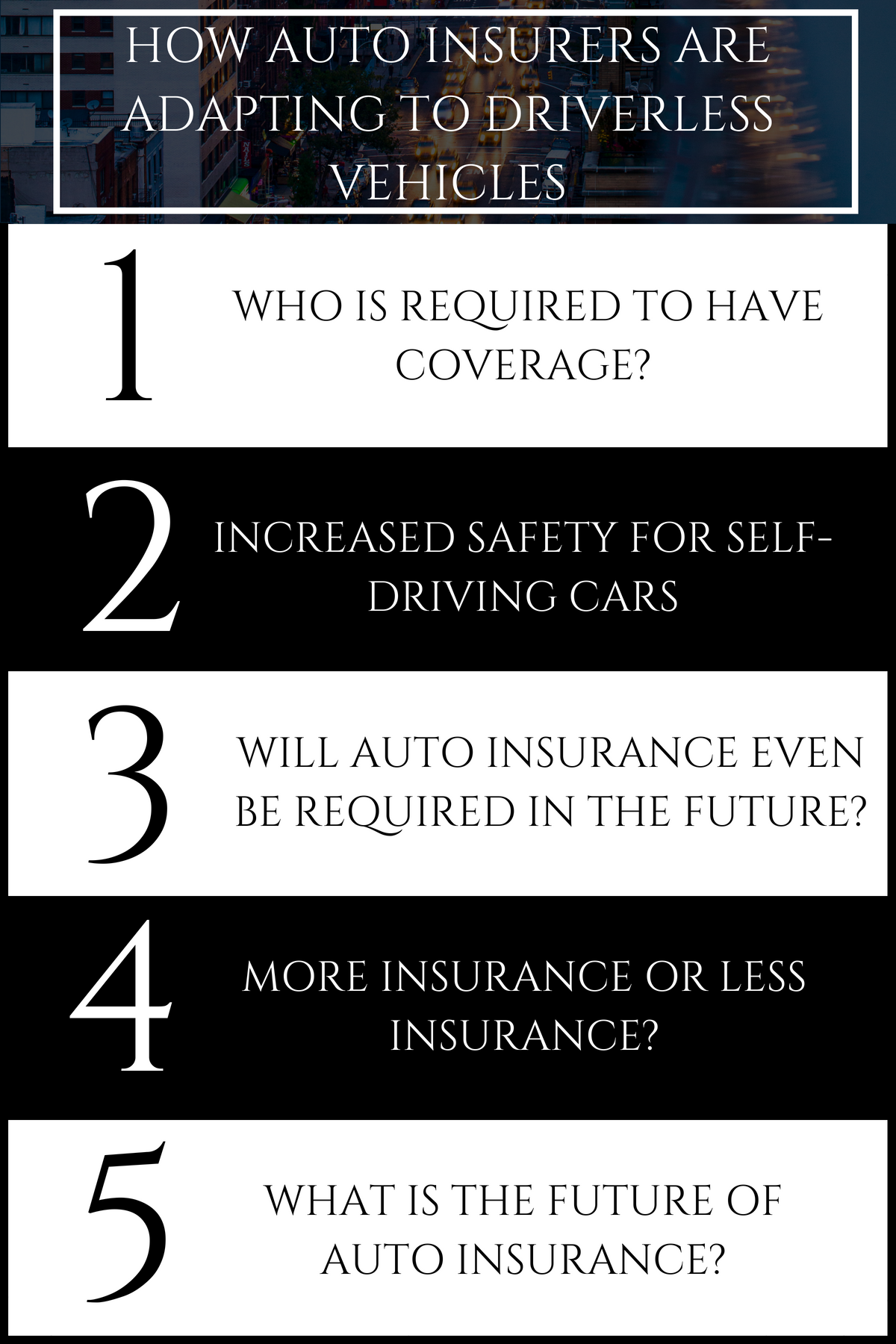

How Auto Insurers Are Adapting To Driverless Vehicles

By: Adam Matheny

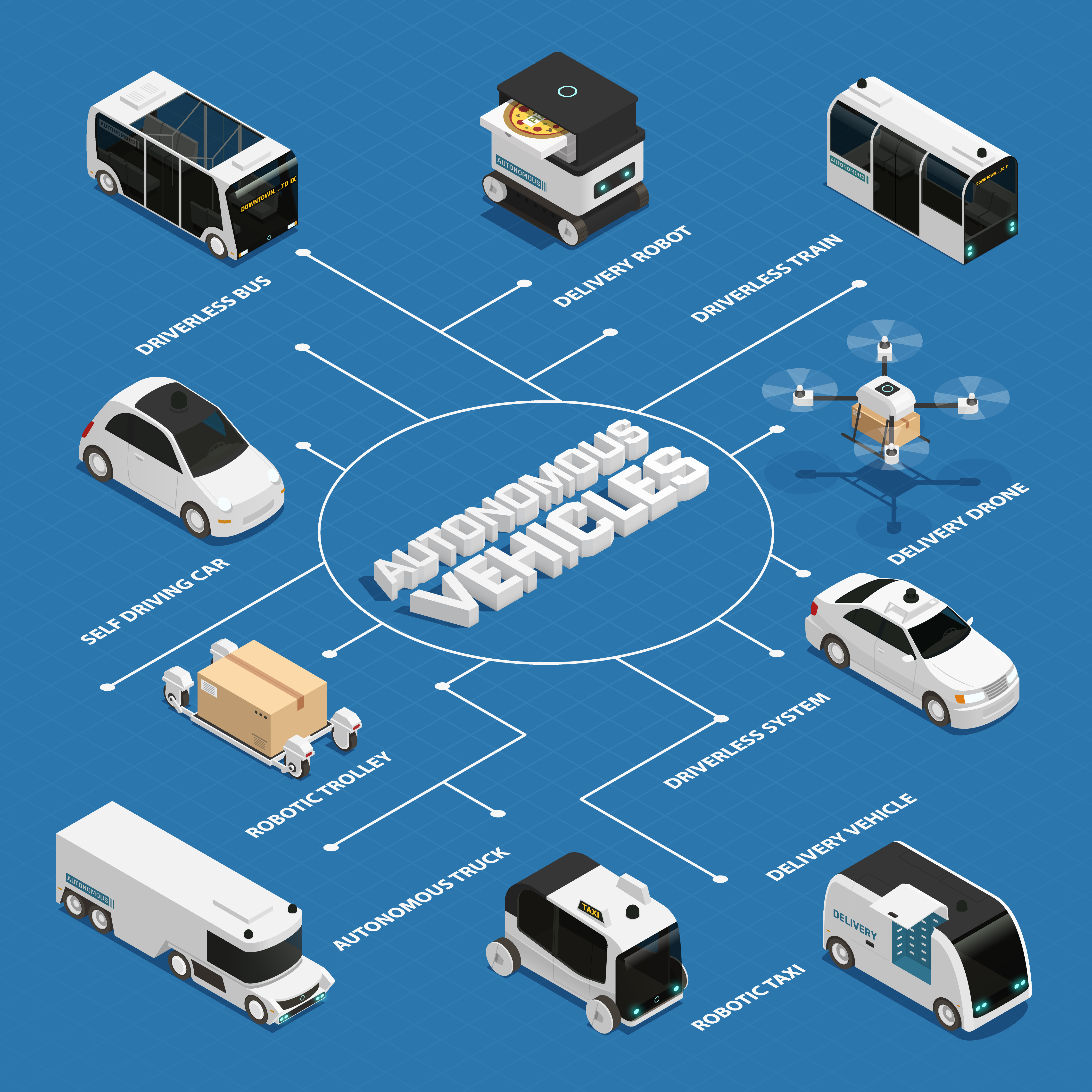

While the public is still fascinated by the idea of self-driving vehicles, these ideas are quickly becoming a reality. The auto insurance industry is trying to figure out how to meet the challenges posed by self-driving vehicles. Who is liable when a car with no driver has an accident that causes damage or injuries? Is the vehicle manufacturer liable? Or is the company that makes the artificial intelligence system that is responsible for the cars navigation? Does the vehicle’s owner bear any of the responsibility? These are just a few of the questions the auto insurance industry is grappling with right now.

Required Coverage, But Who Is Requires To Have Coverage?

Currently, most states require vehicle owners to carry insurance against liability. Some states even require coverage for injury and damages for themselves. Insurance carriers also provide additional coverage options, such as uninsured motorist, which protect insured’s and their vehicles if they are hit by someone that doesn’t have insurance. This additional coverage doesn’t cost a lot and makes the claims process run a lot more smoothly. Many auto insurers are wondering if the current method of purchasing additional insurance to provide protection could be adapted to include protection against damage caused by self-driving vehicles or vehicles that are operated by an artificial intelligence system.

However, auto manufacturers are trying a different approach and offering insurance for the vehicle directly to the new owner, offering insurance through an in house insurer to make it easier for the buyers to provide more protection for the automakers. This may very well become the industry standard as more and more vehicle manufacturers turn toward making self-driving cares or, at the very least, cars that are operated and navigated by artificial intelligence even if the still technically have a human driver.

Increased Safety For Self-Driving Cars

Along with the discussion about liability and responsibility that the makers of self-driving vehicles are having comes the issue of better safety and tracking measures. After all, if an auto maker is going to be held liable for a crash the vehicle needs to be able to document every aspect of the crash so that investigators can reliably figure out where the error occurred. This could lead to self-driving vehicles becoming so safe that owners don’t need to carry insurance anymore. It could end up being the industry standard that cars come insured through the maker and the owners and passengers are covered under a blanket policy that is tied to the vehicle itself through the maker.

The Future Of Auto Insurance

No one cane be sure what the future of auto insurance looks like now that self-driving vehicles are a reality and are beginning to become more common. As auto insurers and auto makers try to figure out the future of auto insurance, the consumers, who are right now still adapting to the use of artificial intelligence in cars, are waiting anxiously to see they will be required to purchase more insurance to protect themselves or if they will be able to drop their coverage and still be protected from liability.

The increased safety measures and overall improved safety that comes from self-driving vehicles will save lives and will also save consumers money in the long run. Whether or not it will cause auto insurance companies to take a hit or force them to expand coverage into other areas remains to be seen. But the auto insurance industry is starting to talk what the future of insurance will look like and that’s an important step in the process of getting ready for the changes that self-driving cars are bringing with them.